With Malaysia’s e-invoicing system being implemented in phases, businesses must ensure they issue e-invoices correctly to comply with Malaysia corporate compliance regulations. Mistakes in e-invoicing can lead to delays, penalties, and tax filing issues.

Whether you’re a local entrepreneur or planning to start a business in Malaysia for foreigners, understanding the correct e-invoicing process is essential.

This guide covers:

✅ What is e-invoicing & why it’s mandatory

✅ How to issue an e-invoice correctly

✅ Common mistakes to avoid

What is E-Invoicing & Why Is It Mandatory?

An e-invoice is a digital invoice submitted electronically to both the recipient and tax authorities. The Royal Malaysian Customs Department (RMCD) and Inland Revenue Board (LHDN) are rolling out mandatory e-invoicing to improve tax compliance and reduce fraud.

💡 By 2024, e-invoicing will be mandatory for businesses exceeding a specific revenue threshold.

Phase 1: Starting on 1 August 2024, targeting companies with revenues over RM100 million.

Phase 2: Beginning 1 January 2025, targeting businesses with revenues above RM25 million.

Phase 2: Beginning 1 July 2025, All taxpayers.

How to Issue an E-Invoice Correctly in Malaysia

To ensure Malaysia corporate compliance, follow these steps:

✅ Step 1: Use an Approved E-Invoicing System

- Businesses must use LHDN-approved e-invoicing software that integrates with the tax system.

- Some accounting platforms offer built-in e-invoicing features for seamless compliance.

✅ Step 2: Include Mandatory Invoice Details

Every e-invoice must contain:

✔ Company name & registration number

✔ Customer details (name, tax ID, and address)

✔ Invoice number & issue date

✔ Itemized breakdown of goods/services

✔ Tax amount (SST/GST, if applicable)

✅ Step 3: Submit Your E-Invoice to LHDN

- Generate and validate the invoice using the approved system.

- Submit the invoice electronically to LHDN for tax compliance.

- Share the verified e-invoice with your customer.

✅ Step 4: Store & Maintain E-Invoice Records

- Keep digital records of all e-invoices for tax audits and reporting.

- Maintain records for at least seven years, as required by tax regulations.

Common E-Invoicing Mistakes to Avoid

🚨 Mistake 1: Missing Key Business Information

Failing to include SSM registration number, tax details, or invoice number can make your e-invoice invalid.

🚨 Mistake 2: Using Unapproved E-Invoicing Software

Only LHDN-compliant e-invoicing systems are accepted. Avoid using manual invoices or non-integrated platforms.

🚨 Mistake 3: Incorrect Tax Calculations

Ensure that SST, service charges, and total amounts are accurately calculated to prevent disputes or tax penalties.

🚨 Mistake 4: Not Keeping E-Invoice Records

Businesses must store and manage e-invoice records for compliance and future audits.

Final Thoughts: Stay Compliant with E-Invoicing Rules

With e-invoicing becoming mandatory in Malaysia, businesses must ensure full compliance to avoid penalties.

✅ Use approved e-invoicing software, No worries,DSY has you covered with the Webix e-Invoice software, fully compliant with LHDN regulations.

✅ Ensure all mandatory invoice details are included

✅ Keep proper e-invoice records for tax purposes

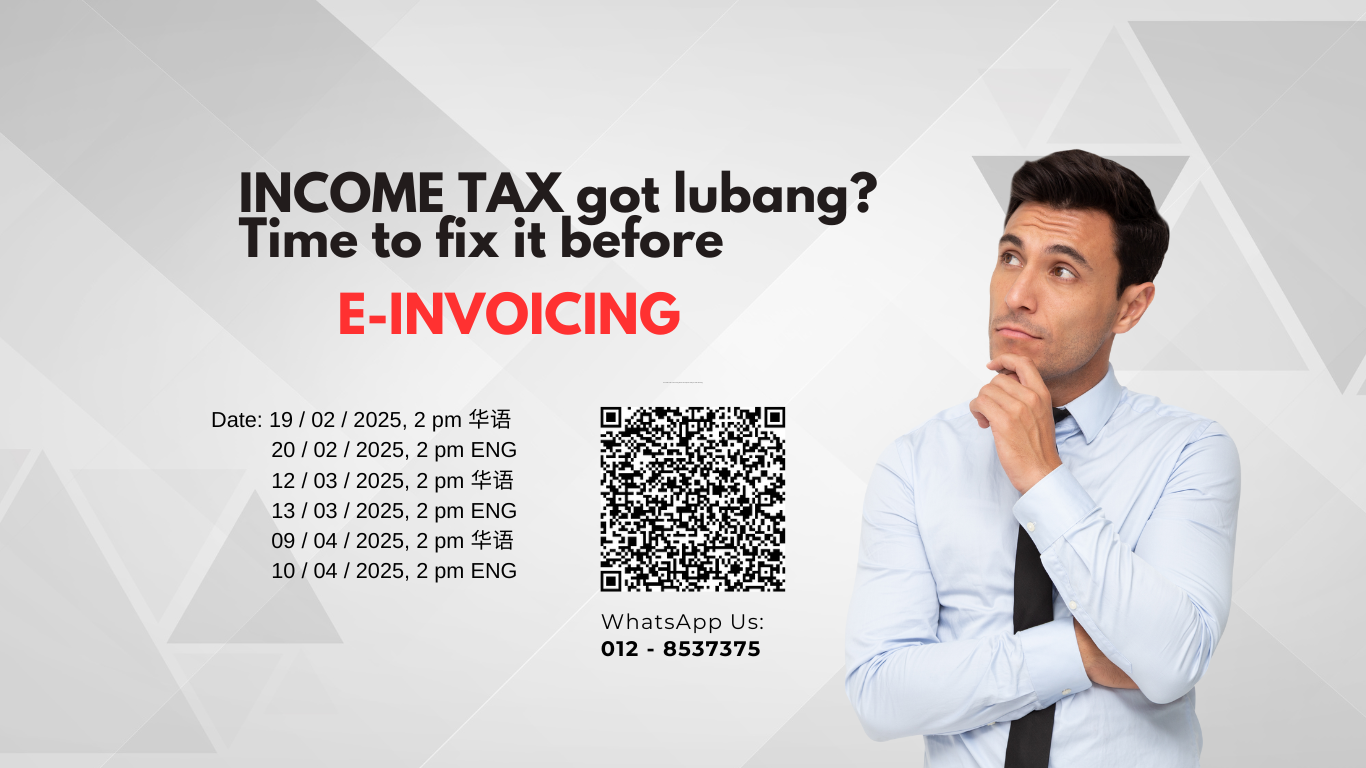

Are you ready to explore e-invoicing and ensure your business is fully prepared for the upcoming changes? Join us for a FREE offline workshop on e-invoicing, hosted by DSY Advisory. Industry experts will guide you through all aspects of e-invoicing implementation, compliance, and best practices.

Register FREE e-Invoicing Offline Workshop Here Now!