Thinking of expanding your business to Malaysia? Whether you’re a local entrepreneur or looking for an overseas business setup Malaysia, opening a corporate bank account is a crucial step. A business bank account ensures smooth financial transactions, credibility, and compliance with local banking regulations.

This guide will walk you through:

✅ The requirements and documents needed

✅ The step-by-step process

✅ Tips to ensure a hassle-free application

Let’s dive in!

Step-by-Step Guide to Opening a Business Bank Account in Malaysia

Step 1: Complete Malaysia Company Incorporation

Before you can open a business bank account Malaysia, your company must be registered with the Companies Commission of Malaysia (SSM).

You’ll need:

✔ Company name & registration number

✔ Business license (if applicable)

✔ Company secretary appointment

Most banks require your business to be fully incorporated before proceeding with account opening.

✔️ Legal Requirement – If you’ve completed your Malaysia company incorporation, you’ll need a business account to operate legally.

✔️ Professionalism – Separating personal and business finances builds credibility.

✔️ Facilitates Transactions – Makes payments, salaries, and tax submissions easier.

✔️ Foreign Investments & Remittances – Required for receiving foreign investments and managing international transactions.Why Do You Need a Corporate Bank Account in Malaysia?

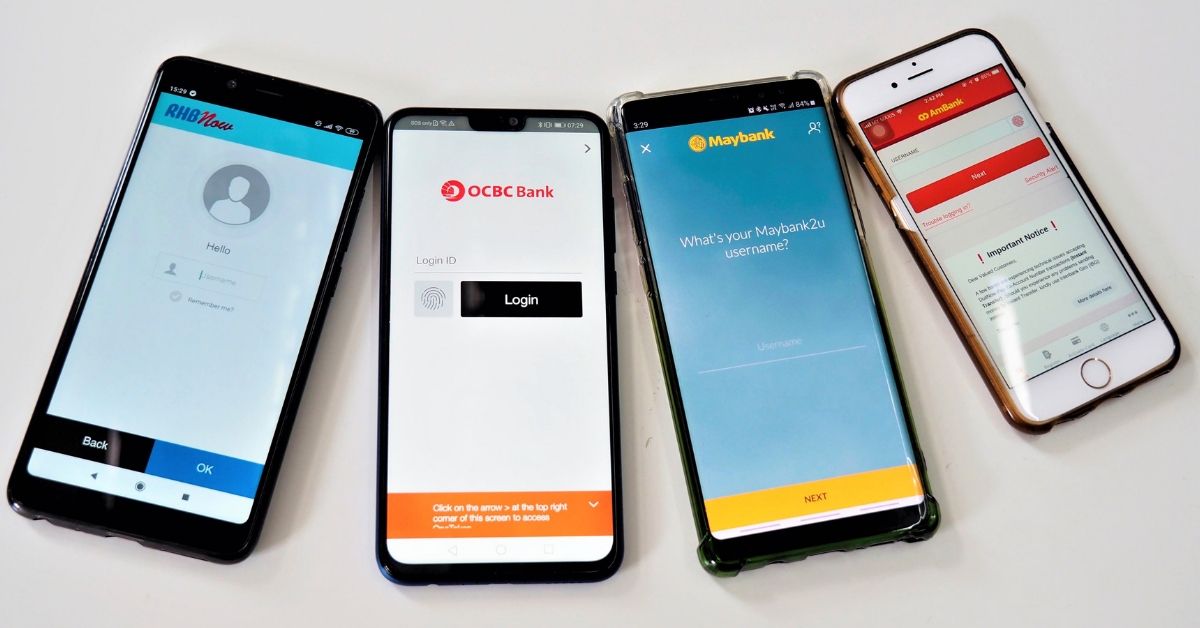

Step 2: Choose the Right Bank

Malaysia has a strong banking sector, offering both local and international banks. Here are some of the top choices:

🏦 Local Banks

- Maybank – Most widely used for business banking

- CIMB Bank – Great for digital banking & SMEs

- Public Bank – Known for stable services and competitive rates

- RHB Bank – Offers specialized business financing

💡 Pro Tip: Choose a bank that aligns with your business needs, transaction volume, and international banking requirements.

Step 3: Gather the Required Documents

🌍 International Banks

- UOB Malaysia – Ideal for global transactions

- Standard Chartered – Good for multinational companies

- OCBC Bank – Strong trade financing options

Every bank has slightly different requirements, but the common documents include:

📜 Company Documents

✅ Certificate of Incorporation (Section 17 & 15)

✅ Notice of Registration from SSM

✅ Company Constitution (if applicable)

✅ Company profile from SSM (Section 14 & 58)

👥 Director & Shareholder Documents

✅ Passport (for foreigners) or NRIC (for Malaysians)

✅ Proof of residential address (utility bill or bank statement)

📄 Other Documents (May Be Required)

✅ Business license (if applicable)

✅ Board resolution authorizing the account opening

✅ Tax registration documents (if available)

Some banks may request additional documentation based on your business structure and industry.

Step 4: Schedule an Appointment with the Bank

Most banks require a physical presence for account opening. Here’s what happens during the appointment:

✅ Verification of documents – Bank officers will review your paperwork.

✅ Director’s presence – At least one director (or all, depending on the bank) must be present.

✅ Initial deposit – Some banks require a minimum deposit (varies by bank & account type).

💡 Tip: Call ahead to confirm the exact requirements and minimum deposit amount to avoid delays.

Step 5: Account Approval & Activation

Once everything is verified, the bank will:

✔ Approve your application (usually takes 3-7 working days)

✔ Provide your account details & online banking access

✔ Issue a business debit card (if applicable)

Congratulations! 🎉 Your corporate bank account is now ready to use.

Tips for a Smooth Application Process

🔹 Ensure All Directors Are Available – Some banks require all directors to be present.

🔹 Prepare All Documents in Advance – Missing paperwork can delay the process.

🔹 Choose a Bank That Supports Foreign Transactions – If you deal with international clients, opt for a multi-currency account.

🔹 Maintain Proper Malaysia Corporate Compliance – Keep your company records up to date to avoid issues.

🔹 Consult Your Company Secretary – They can assist with documentation and appointments.

Conclusion: Get Your Business Bank Account Opened Easily!

Opening a business bank account in Malaysia is a straightforward process if you have the right documents and meet the bank’s requirements. Whether you’re planning an overseas business setup Malaysia or expanding a local company, a corporate account is essential for smooth operations.

✅ Make sure your company is properly registered

✅ Gather all required documents

✅ Choose the right bank for your business needs

✅ Follow the correct procedures for a hassle-free experience

🚀 Ready to open a business bank account Malaysia? Get started today and set your company up for success!